Optimize Your Home Financing Prospective with a Mortgage Broker Glendale CA

Optimize Your Home Financing Prospective with a Mortgage Broker Glendale CA

Blog Article

Exploring Why Partnering With a Home Loan Broker Can Considerably Streamline Your Home Purchasing Experience

Browsing the complexities of the home acquiring process can be daunting, yet partnering with a home loan broker offers a calculated advantage that can enhance this experience. By acting as middlemans in between you and a broad selection of lenders, brokers give access to tailored loan choices and experienced insights that can alleviate possible obstacles. Their efficiency not just enhances effectiveness yet also promotes a much more tailored approach to protecting desirable terms. As we explore the various aspects of this collaboration, one might examine just how these advantages manifest in real-world scenarios and effect your general trip.

Understanding Mortgage Brokers

These specialists have comprehensive knowledge of the home loan sector and its regulations, enabling them to browse the intricacies of the borrowing process effectively. They help consumers in collecting required paperwork, finishing funding applications, and guaranteeing that all demands are satisfied for a smooth authorization process. By working out terms in behalf of the debtor, home mortgage brokers often work to secure beneficial rate of interest rates and problems.

Eventually, the expertise and resources of mortgage brokers can significantly simplify the home buying experience, alleviating several of the worries commonly related to protecting financing. Their role is crucial in helping borrowers make notified decisions tailored to their distinct situations and economic objectives.

Advantages of Utilizing a Broker

Utilizing a home mortgage broker can use various advantages for homebuyers and those aiming to re-finance. One considerable benefit is access to a wider variety of car loan alternatives. Unlike financial institutions that may only offer their own items, brokers deal with numerous loan providers, enabling customers to check out various mortgage solutions customized to their particular financial circumstances.

Furthermore, home mortgage brokers have considerable sector expertise and competence. They remain informed about market trends, interest prices, and lending institution needs, guaranteeing their customers get timely and accurate information. This can lead to more desirable loan terms and possibly reduced rate of interest rates.

Additionally, brokers can help identify and resolve possible obstacles early in the mortgage procedure. Their experience enables them to visualize challenges that might develop, such as debt concerns or paperwork requirements, which can conserve clients time and stress.

Finally, collaborating with a home mortgage broker commonly causes customized solution. Brokers normally invest time in recognizing their clients' unique demands, leading to an extra tailored technique to the home-buying experience. This mix of gain access to, competence, and individualized solution makes partnering with a mortgage broker an invaluable property for any buyer or refinancer.

Streamlined Application Process

The process of obtaining a home mortgage can commonly be overwhelming, however partnering with a broker significantly streamlines it (Mortgage Broker Glendale CA). A home mortgage broker serves as an intermediary in between the loan provider and the consumer, enhancing the application process with specialist guidance and organization. They start by assessing your monetary scenario, collecting required documents, and recognizing your specific requirements, making certain that the application is tailored to your situations

Brokers are fluent in the details of mortgage applications, assisting you stay clear of usual pitfalls. They offer clearness on required paperwork, such as revenue confirmation, credit history records, and property declarations, making it easier for you to gather and submit these materials. With their comprehensive experience, brokers can expect prospective challenges and address them proactively, reducing irritations and hold-ups.

Access to Several Lenders

Accessibility to a diverse array of lending institutions is one of the crucial benefits of partnering with a home loan broker. Unlike typical home buying techniques, where customers are frequently restricted to 1 or 2 loan providers, home loan brokers have actually established relationships with a wide variety of banks. This extensive network allows brokers to existing customers with numerous lending choices customized to their financial situations and unique needs.

By having accessibility to numerous lenders, brokers can quickly identify competitive rates of interest and desirable terms that might not be readily available via direct networks. This not only enhances the potential for securing a more beneficial home loan however likewise expands the range of offered products, including specialized finances for newbie purchasers, professionals, or those seeking to invest in homes.

Additionally, this gain access to saves time and effort for homebuyers. Rather click to investigate than speaking to numerous lending institutions separately, a home loan broker can simplify the process by gathering necessary documentation and submitting applications to several lending institutions all at once. This performance can lead to quicker approval times and a smoother overall experience, permitting customers to concentrate on discovering their suitable home instead of browsing the complexities of home mortgage options alone.

Customized Advice and Assistance

Navigating the mortgage landscape can be frustrating, but partnering with a home mortgage broker supplies customized guidance and assistance tailored per client's details requirements. Mortgage brokers function as intermediaries, comprehending individual monetary situations, choices, and long-term objectives. This personalized technique guarantees that customers receive recommendations and services that straighten with their unique conditions.

A competent home loan broker performs thorough analyses to determine the most effective funding alternatives, thinking about variables such as credit report, income, and debt-to-income ratios. this post They additionally educate clients on numerous mortgage products, aiding them understand the implications of different rate of interest terms, prices, and costs. This knowledge equips clients to make educated choices.

Moreover, a mortgage broker provides continuous assistance throughout the whole home acquiring procedure. From pre-approval to closing, they facilitate communication in between lenders and clients, dealing with any type of issues that may arise. This continual assistance alleviates stress and saves time, allowing clients to focus on finding their dream home.

Conclusion

To conclude, partnering with a mortgage broker offers numerous benefits that can significantly boost the home acquiring experience. By giving accessibility to a large variety of finance choices, promoting a structured application procedure, and providing professional guidance, brokers effectively minimize obstacles and minimize tension for homebuyers. This specialist assistance not only improves performance however likewise boosts the probability of securing desirable financing terms, eventually contributing to an extra effective and rewarding home purchasing trip.

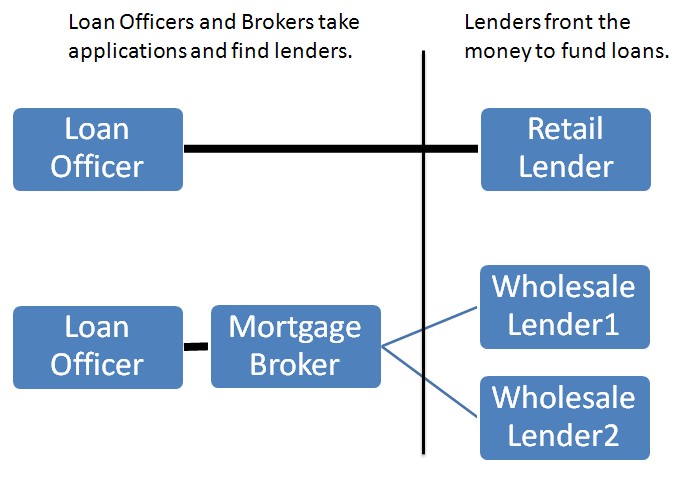

Navigating the intricacies of the home getting process can be overwhelming, yet partnering with a home mortgage broker uses a tactical benefit that can enhance this experience.Mortgage brokers offer as intermediaries in between borrowers and lending institutions, helping with the loan process for those looking for to purchase a home or re-finance an existing home mortgage. By streamlining the application, a home mortgage broker enhances your home getting experience, allowing you to focus on locating your dream home.

Unlike standard home getting methods, where purchasers are usually limited to one or two lending institutions, home loan brokers have actually established connections with a vast range of monetary establishments - Mortgage Broker Glendale CA.Navigating the mortgage landscape can be overwhelming, yet partnering with a mortgage broker offers individualized advice and support tailored to each client's details requirements

Report this page